Changes to Mortgage Insurance Premiums after April 1st 2013

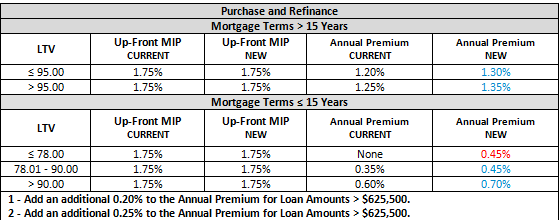

FHA will increase its annual mortgage insurance premium (MIP) for most new mortgages by 10 basis

points or by 0.10 percent. FHA will increase premiums on jumbo mortgages ($625,500 or larger) by 5 basis points or 0.05 percent, to the maximum authorized annual mortgage insurance premium. These premium increases exclude certain streamline refinance transactions.

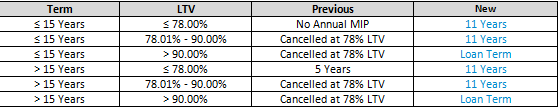

FHA will also require most FHA borrowers to continue paying annual premiums for the life of their mortgage loan.

Commencing in 2001, FHA cancelled required MIP on loans when the outstanding principal balance reached 78 percent of the original principal balance. However, FHA remains responsible for insuring 100 percent of the outstanding loan balance throughout the entire life of the loan, a term which often extends far beyond the cessation of these MIP payments. FHA’s Office of Risk Management and Regulatory Affairs estimates that the MMI Fund has foregone billions of dollars in premium revenue on mortgages endorsed from 2010 through 2012 because of this automatic cancellation policy. Therefore, FHA will once again collect premiums based upon the unpaid principal balance for the entire period for which FHA is entitled. This will permit FHA to retain significant revenue that is currently being forfeited prematurely.

Read FHA's new MIP Mortgagee Letter

http://portal.hud.gov/hudportal/HUD?src=/press/press_releases_media_advisories/2013/HUDNo.13-010

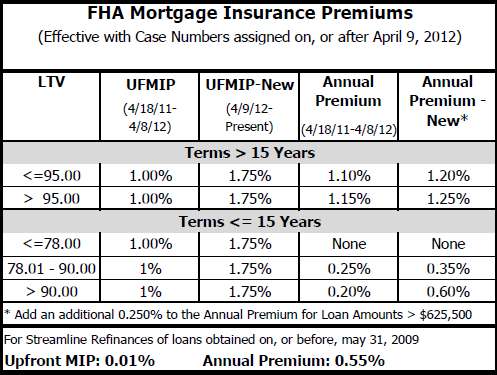

The Current MIP and UFMIP Terms

FHA will increase its annual mortgage insurance premium (MIP) for most new mortgages by 10 basis

points or by 0.10 percent. FHA will increase premiums on jumbo mortgages ($625,500 or larger) by 5 basis points or 0.05 percent, to the maximum authorized annual mortgage insurance premium. These premium increases exclude certain streamline refinance transactions.

FHA will also require most FHA borrowers to continue paying annual premiums for the life of their mortgage loan.

Commencing in 2001, FHA cancelled required MIP on loans when the outstanding principal balance reached 78 percent of the original principal balance. However, FHA remains responsible for insuring 100 percent of the outstanding loan balance throughout the entire life of the loan, a term which often extends far beyond the cessation of these MIP payments. FHA’s Office of Risk Management and Regulatory Affairs estimates that the MMI Fund has foregone billions of dollars in premium revenue on mortgages endorsed from 2010 through 2012 because of this automatic cancellation policy. Therefore, FHA will once again collect premiums based upon the unpaid principal balance for the entire period for which FHA is entitled. This will permit FHA to retain significant revenue that is currently being forfeited prematurely.

Read FHA's new MIP Mortgagee Letter

http://portal.hud.gov/hudportal/HUD?src=/press/press_releases_media_advisories/2013/HUDNo.13-010

The Current MIP and UFMIP Terms

These are the NEW MIP and UFMIP terms going forward after April 1, 2013.

FHA charges Two Mortgage Insurance fees on each loan;

- Up Front Mortgage Insurance Premium (UFMIP)

- Annual mortgage Insurance (MIP) paid monthly.

FHA Upfront Mortgage Insurance Premiums (UFMIP)

UFMIP Fee is paid once and is typically financed by adding it to the loan amount although it may also be paid in cash by the buyer or seller.

Below are the current premiums:

- Purchase Money and Qualifying FHA Refinances after 4/9/2012 = 1.75 Percent of the principle loan amount.

Monthly Mortgage Insurance Premium (MIP)

An annual premium, shown below, paid monthly, will also be charged based on the initial Loan to Value and length of the mortgage according to the following schedule:

30 Year Loans MIP Fee for loan amounts <=$625,500

- Loan to Value Less than 95% = 1.20%

- Loan to Value Greater than 95% =1.25%

30 Year Loans MIP Fee for loan amounts >$625,500

- Loan to Value Less than 95% = 1.45%

- Loan to Value Greater than 95% =1.50%

15 Year Loans MIP Fee for loan amounts <= $625,500

- Loan to Value Less than 90% = 0.35

- Loan to Value Greater than 90% = 0.60

- Loan to Value Less than 90% = 0.60

- Loan to Value Greater than 90% = 0.80

FHA UFMIP Fee may be canceled

- The home must be owned for at least five years.

- And, the loan amount must be 78% or less of the original purchase price.

FHA Upfront Mortgage Insurance (UFMIP) Fee is refundable.

A portion of UFMIP may be refundable under the following conditions:

- Refinanced within three years.

- The new loan must be a FHA refinance.

Year/Mo 1 2 3 4 5 6 7 8 9 10 11 12

1 80 78 76 74 72 70 68 66 64 62 60 58

2 56 54 52 50 48 46 44 42 40 38 36 34

3 32 30 28 26 24 22 20 18 16 14 12 10%

Whats the deal with the APR being sooooo much higher than my NOTE rate?

As you know, the borrower paid UFMIP is an APR affecting fee.

When lenders advertise mortgage rates, they are required to display an additional number called the annual percentage rate, or APR.

The advertised rate is the one used to calculate your mortgage payment. Borrow $100,000 at five percent with a 30-year term, and the payment is $537. But an advertised rate tells you nothing about the cost of the loan or if it’s a good deal. Suppose you’re offered two loans. Both have a five percent rate, but one costs $1,000 and the other costs $4,000. They’re obviously not the same!

How is APR calculated?

In the example above, the payment for both loans is $537 per month. But because the first loan costs $1,000, you’re only actually getting $99,000 for that $537 monthly payment. When you pay $537 a month to borrow $99,000 the rate is 5.09 percent. The second loan costs $4,000, so for your $537 a month, you only get to borrow $96,000. In that case, the APR is 5.35%.

You don’t really need an APR calculation to tell you that the first loan is the better deal – it’s pretty obvious. But what if a five percent loan costs $1,000 but a 4.5 percent loan costs $4,000? Which is a better deal? That’s where APR comes in. The APR of the five percent loan in this case is 5.09 percent. The APR for the second loan is 4.85 percent. That means over the life of the loan, the second loan costs less than the first loan.

Is the loan with the lowest APR always the best?

Many people think that the loan with the lowest APR is automatically the best deal. That’s not true unless you keep your mortgage for its entire term. If not, the upfront costs of getting your mortgage are spread out over a shorter period of time, and that changes the true cost of the loan. Look at our two $100,000 30-year fixed loans again, but this time we’ll assume that you’ll sell the home in five years.

When you change the first loan’s term from 30 years to five years, its APR increases from 5.09 percent to 5.41 percent. And the second loan with its $4,000 in costs? It increases from 4.85 percent to 6.12 percent!

ARMs

Because no one can predict how interest rates will change over the years, the APR for adjustable-rate mortgages is calculated on the assumption that the loan is adjusting at that time. So if you have a 5/1 mortgage starting at three percent, and if it were adjusting today its rate would be six percent, that’s the rate used in the APR calculation. Even though it’s highly unlikely that rates in five years will be exactly what they are today.

The most important thing to remember when comparing APRs of ARMs is that they are calculated based on current economic conditions. The APR of a loan on Monday may be different from the APR of that same loan on Friday. You need to get your mortgage quotes on the same day (preferably at the same time). This is easiest to manage by getting your quotes online.

Wells Fargo to Wells Fargo FHA Streamlines

6 month seasoning required

If the loan is seasoned 12 months or more, evidence that the existing loan has not had any 30-day or greater mortgage lates in the past 12 months

If loan is seasoned less than 12 months, evidence:

a) The existing loan has no 30-day or greater mortgage lates since the inception of the loan and

b) No 30-day or greater mortgage lates for any other first mortgage loans associated with the property

and borrower(s) in the most recent 12 months

Income documentation and employment verification is required. However ratios will not be calculated

4506-T or tax return transcripts are not required on a non-credit qualifying streamline

Assets required 2 months consecutive bank statements

Mortgage only credit report allowed with Fico Scores

Mid Fico 640 with loan amount below $ 417,000

Mid Fico 660 with loan amount above $ 417,000

High balance only allowed on following programs

Loan term must be 30 year or 15 year fixed (3/1 and 5/1 not eligible)

FHA Case number must be assigned on or after November 17,2009

All other conditions may apply.

REAL LIFE EXAMPLE:

Q: Is the monthly mortgage insurance something that continues for the life of the loan?

Q: I don't know if it is paid for a certain duration of time or if it is Paid until the principal drops below a certain amount.

A: No, it will only be a requirement for the 1st five years and will automatically fall off @ 78% loan to value.

Q: With respect to the tax and insurance that will be paid out of the escrow account, which taxes and which insurance? Property taxes? Home owners insurance? Other types of taxes and insurance that I don't know about?

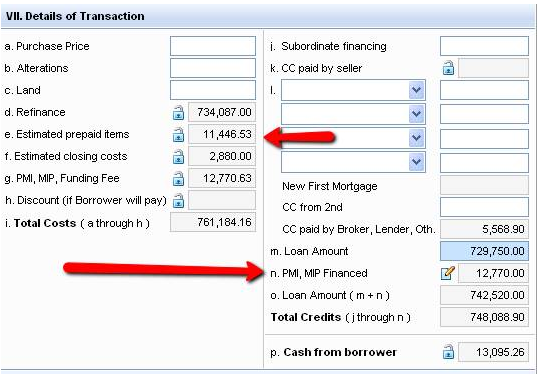

A: Yes, taxes and insurance will be included and lumped into just one payment. ( see clip below )..

When taxes and Insurance are due, the loan servicer will pay them

That’s why a six month prorated amount is collected upfront to get the account started.

( Taxes : $8508 yr / 12 X 6 )

( Insurance $1068yr / 12 X 6 )

It’s a requirement for all FHA loans. You should know that the initial figure is not exact.

It’s an estimate using a pro-rated amount of six months of each taxes and insurance. ( $11,446 ) Box E below

By the time we close and record it can be reduced only because taxes are due now and the next installment may be made by then

The 2nd arrow points to the financed UFMIP amount. This amount is added to your base loan amount of $729,750 and is deposited with FHA.

Consider it like a deposit or a down payment on the insurance policy.

The UFMIP amount is calculated by multiplying the base loan amount by 1.75% ($729,750 X .0175 ).

See the next clip?

If you were to sell your home or refinance in the next three years, you would receive a scheduled refund.

This amount is calculated by the next clip.

See the red box with the # 62 ?

1st year, 10th month?

If you were to sell or refinance 10 months from now, this would be the refunded percentage amount of your UFMIP balance.

( $12,770 X .62 ) = $7,917.78

203K LOANS

Rehab a Home w/HUD's 203(k) The Federal Housing Administration (FHA), which is part of the Department of Housing and Urban Development (HUD), administers various single family mortgage insurance programs. These programs operate through FHA-approved lending institutions which submit applications to have the property appraised and have the buyer's credit approved. These lenders fund the mortgage loans which the Department insures. HUD does not make direct loans to help people buy homes.

The Section 203(k) program is the Department's primary program for the rehabilitation and repair of single family properties. As such, it is an important tool for community and neighborhood revitalization and for expanding homeownership opportunities. Since these are the primary goals of HUD, the Department believes that Section 203(k) is an important program and we intend to continue to strongly support the program and the lenders that participate in it.

Many lenders have successfully used the Section 203(k) program in partnership with state and local housing agencies and nonprofit organizations to rehabilitate properties. These lenders, along with state and local government agencies, have found ways to combine Section 203(k) with other financial resources, such as HUD's HOME, HOPE, and Community Development Block Grant Programs, to assist borrowers. Several state housing finance agencies have designed programs, specifically for use with Section 203(k) and some lenders have also used the expertise of local housing agencies and nonprofit organizations to help manage the rehabilitation processing.

The Department also believes that the Section 203(k) program is an excellent means for lenders to demonstrate their commitment to lending in lower income communities and to help meet their responsibilities under the Community Reinvestment Act (CRA). HUD is committed to increasing homeownership opportunities for families in these communities and Section 203(k) is an excellent product for use with CRA-type lending programs.

If you have questions about the 203(k) program or are interested in getting a 203(k) insured mortgage loan, we suggest that you get in touch with an FHA-approved lender in your area or the Homeownership Center in your area.

IntroductionSection 10 1 (c) (1) of the Housing and Community Development Amendments of 1978 (Public Law 95557) amends Section 203(k) of the National Housing Act (NHA). The objective of the revision is to enable HUD to promote and facilitate the restoration and preservation of the Nation's existing housing stock. The provisions of Section 203(k) are located in Chapter II of Title 24 of the Code of Federal Regulations under Section 203.50 and Sections 203.440 through 203.494. Program instructions are in HUD Handbook 4240-4. HUD Handbooks may be ordered online from The HUD Compendium or from HUDCLIPS. 203(k) - How It Is Different Most mortgage financing plans provide only permanent financing. That is, the lender will not usually close the loan and release the mortgage proceeds unless the condition and value of the property provide adequate loan security. When rehabilitation is involved, this means that a lender typically requires the improvements to be finished before a long-term mortgage is made.

When a homebuyer wants to purchase a house in need of repair or modernization, the homebuyer usually has to obtain financing first to purchase the dwelling; additional financing to do the rehabilitation construction; and a permanent mortgage when the work is completed to pay off the interim loans with a permanent mortgage. Often the interim financing (the acquisition and construction loans) involves relatively high interest rates and short amortization periods. The Section 203(k) program was designed to address this situation. The borrower can get just one mortgage loan, at a long-term fixed (or adjustable) rate, to finance both the acquisition and the rehabilitation of the property. To provide funds for the rehabilitation, the mortgage amount is based on the projected value of the property with the work completed, taking into account the cost of the work. To minimize the risk to the mortgage lender, the mortgage loan (the maximum allowable amount) is eligible for endorsement by HUD as soon as the mortgage proceeds are disbursed and a rehabilitation escrow account is established. At this point the lender has a fully-insured mortgage loan.

Eligible Property To be eligible, the property must be a one- to four-family dwelling that has been completed for at least one year. The number of units on the site must be acceptable according to the provisions of local zoning requirements. All newly constructed units must be attached to the existing dwelling. Cooperative units are not eligible.

Homes that have been demolished, or will be razed as part of the rehabilitation work, are eligible provided some of the existing foundation system remains in place.

In addition to typical home rehabilitation projects, this program can be used to convert a one-family dwelling to a two-, three-, or four-family dwelling. An existing multi-unit dwelling could be decreased to a one- to four-family unit.

An existing house (or modular unit) on another site can be moved onto the mortgaged property; however, release of loan proceeds for the existing structure on the non-mortgaged property is not allowed until the new foundation has been properly inspected and the dwelling has been properly placed and secured to the new foundation.

A 203(k) mortgage may be originated on a "mixed use" residential property provided: (1) The property has no greater than 25 percent (for a one story building); 33 percent (for a three story building); and 49 percent (for a two story building) of its floor area used for commercial (storefront) purposes; (2) the commercial use will not affect the health and safety of the occupants of the residential property; and (3) the rehabilitation funds will only be used for the residential functions of the dwelling and areas used to access the residential part of the property.

Condominium Unit The Department also permits Section 203(k) mortgages to be used for individual units in condominium projects that have been approved by FHA.

The 203(k) program was not intended to be a project mortgage insurance program, as large scale development has considerably more risk than individual single-family mortgage insurance. Therefore, condominium rehabilitation is subject to the following conditions:

Owner/occupant and qualified non-profit borrowers only; no investors; Rehabilitation is limited only to the interior of the unit. Mortgage proceeds are not to be used for the rehabilitation of exteriors or other areas which are the responsibility of the condominium association, except for the installation of firewalls in the attic for the unit; Only the lesser of five units per condominium association, or 25 percent of the total number of units, can be undergoing rehabilitation at any one time; The maximum mortgage amount cannot exceed 100 percent of after-improved value. After rehabilitation is complete, the individual buildings within the condominium must not contain more than four units. By law, Section 203(k) can only be used to rehabilitate units in one-to-four unit structures. However, this does not mean that the condominium project, as a whole, can only have four units or that all individual structures must be detached.

Example: A project might consist of six buildings each containing four units, for a total of 24 units in the project and, thus, be eligible for Section 203(k). Likewise, a project could contain a row of more than four attached townhouses and be eligible for Section 203(k) because HUD considers each townhouse as one structure, provided each unit is separated by a 1 1/2 hour firewall (from foundation up to the roof).

Similar to a project with a condominium unit with a mortgage insured under Section 234(c) of the National Housing Act, the condominium project must be approved by HUD prior to the closing of any individual mortgages on the condominium units.

How the Program Can Be Used This program can be used to accomplish rehabilitation and/or improvement of an existing one-to-four unit dwelling in one of three ways:

To purchase a dwelling and the land on which the dwelling is located and rehabilitate it. To purchase a dwelling on another site, move it onto a new foundation on the mortgaged property and rehabilitate it. To refinance existing liens secured against the subject property and rehabilitate such a dwelling. To purchase a dwelling and the land on which the dwelling is located and rehabilitate it, and to refinance existing indebtedness and rehabilitate such a dwelling, the mortgage must be a first lien on the property and the loan proceeds (other than rehabilitation funds) must be available before the rehabilitation begins.

To purchase a dwelling on another site, move it onto a new foundation and rehabilitate it, the mortgage must be a first lien on the property; however, loan proceeds for the moving of the house cannot be made available until the unit is attached to the new foundation.

Eligible Improvements Luxury items and improvements are not eligible as a cost rehabilitation. However, the homeowner can use the 203(k) program to finance such items as painting, room additions, decks and other items even if the home does not need any other improvements. All health, safety and energy conservation items must be addressed prior to completing general home improvements.

Rehab a Home w/HUD's 203(k) The Federal Housing Administration (FHA), which is part of the Department of Housing and Urban Development (HUD), administers various single family mortgage insurance programs. These programs operate through FHA-approved lending institutions which submit applications to have the property appraised and have the buyer's credit approved. These lenders fund the mortgage loans which the Department insures. HUD does not make direct loans to help people buy homes.

The Section 203(k) program is the Department's primary program for the rehabilitation and repair of single family properties. As such, it is an important tool for community and neighborhood revitalization and for expanding homeownership opportunities. Since these are the primary goals of HUD, the Department believes that Section 203(k) is an important program and we intend to continue to strongly support the program and the lenders that participate in it.

Many lenders have successfully used the Section 203(k) program in partnership with state and local housing agencies and nonprofit organizations to rehabilitate properties. These lenders, along with state and local government agencies, have found ways to combine Section 203(k) with other financial resources, such as HUD's HOME, HOPE, and Community Development Block Grant Programs, to assist borrowers. Several state housing finance agencies have designed programs, specifically for use with Section 203(k) and some lenders have also used the expertise of local housing agencies and nonprofit organizations to help manage the rehabilitation processing.

The Department also believes that the Section 203(k) program is an excellent means for lenders to demonstrate their commitment to lending in lower income communities and to help meet their responsibilities under the Community Reinvestment Act (CRA). HUD is committed to increasing homeownership opportunities for families in these communities and Section 203(k) is an excellent product for use with CRA-type lending programs.

If you have questions about the 203(k) program or are interested in getting a 203(k) insured mortgage loan, we suggest that you get in touch with an FHA-approved lender in your area or the Homeownership Center in your area.

IntroductionSection 10 1 (c) (1) of the Housing and Community Development Amendments of 1978 (Public Law 95557) amends Section 203(k) of the National Housing Act (NHA). The objective of the revision is to enable HUD to promote and facilitate the restoration and preservation of the Nation's existing housing stock. The provisions of Section 203(k) are located in Chapter II of Title 24 of the Code of Federal Regulations under Section 203.50 and Sections 203.440 through 203.494. Program instructions are in HUD Handbook 4240-4. HUD Handbooks may be ordered online from The HUD Compendium or from HUDCLIPS. 203(k) - How It Is Different Most mortgage financing plans provide only permanent financing. That is, the lender will not usually close the loan and release the mortgage proceeds unless the condition and value of the property provide adequate loan security. When rehabilitation is involved, this means that a lender typically requires the improvements to be finished before a long-term mortgage is made.

When a homebuyer wants to purchase a house in need of repair or modernization, the homebuyer usually has to obtain financing first to purchase the dwelling; additional financing to do the rehabilitation construction; and a permanent mortgage when the work is completed to pay off the interim loans with a permanent mortgage. Often the interim financing (the acquisition and construction loans) involves relatively high interest rates and short amortization periods. The Section 203(k) program was designed to address this situation. The borrower can get just one mortgage loan, at a long-term fixed (or adjustable) rate, to finance both the acquisition and the rehabilitation of the property. To provide funds for the rehabilitation, the mortgage amount is based on the projected value of the property with the work completed, taking into account the cost of the work. To minimize the risk to the mortgage lender, the mortgage loan (the maximum allowable amount) is eligible for endorsement by HUD as soon as the mortgage proceeds are disbursed and a rehabilitation escrow account is established. At this point the lender has a fully-insured mortgage loan.

Eligible Property To be eligible, the property must be a one- to four-family dwelling that has been completed for at least one year. The number of units on the site must be acceptable according to the provisions of local zoning requirements. All newly constructed units must be attached to the existing dwelling. Cooperative units are not eligible.

Homes that have been demolished, or will be razed as part of the rehabilitation work, are eligible provided some of the existing foundation system remains in place.

In addition to typical home rehabilitation projects, this program can be used to convert a one-family dwelling to a two-, three-, or four-family dwelling. An existing multi-unit dwelling could be decreased to a one- to four-family unit.

An existing house (or modular unit) on another site can be moved onto the mortgaged property; however, release of loan proceeds for the existing structure on the non-mortgaged property is not allowed until the new foundation has been properly inspected and the dwelling has been properly placed and secured to the new foundation.

A 203(k) mortgage may be originated on a "mixed use" residential property provided: (1) The property has no greater than 25 percent (for a one story building); 33 percent (for a three story building); and 49 percent (for a two story building) of its floor area used for commercial (storefront) purposes; (2) the commercial use will not affect the health and safety of the occupants of the residential property; and (3) the rehabilitation funds will only be used for the residential functions of the dwelling and areas used to access the residential part of the property.

Condominium Unit The Department also permits Section 203(k) mortgages to be used for individual units in condominium projects that have been approved by FHA.

The 203(k) program was not intended to be a project mortgage insurance program, as large scale development has considerably more risk than individual single-family mortgage insurance. Therefore, condominium rehabilitation is subject to the following conditions:

Owner/occupant and qualified non-profit borrowers only; no investors; Rehabilitation is limited only to the interior of the unit. Mortgage proceeds are not to be used for the rehabilitation of exteriors or other areas which are the responsibility of the condominium association, except for the installation of firewalls in the attic for the unit; Only the lesser of five units per condominium association, or 25 percent of the total number of units, can be undergoing rehabilitation at any one time; The maximum mortgage amount cannot exceed 100 percent of after-improved value. After rehabilitation is complete, the individual buildings within the condominium must not contain more than four units. By law, Section 203(k) can only be used to rehabilitate units in one-to-four unit structures. However, this does not mean that the condominium project, as a whole, can only have four units or that all individual structures must be detached.

Example: A project might consist of six buildings each containing four units, for a total of 24 units in the project and, thus, be eligible for Section 203(k). Likewise, a project could contain a row of more than four attached townhouses and be eligible for Section 203(k) because HUD considers each townhouse as one structure, provided each unit is separated by a 1 1/2 hour firewall (from foundation up to the roof).

Similar to a project with a condominium unit with a mortgage insured under Section 234(c) of the National Housing Act, the condominium project must be approved by HUD prior to the closing of any individual mortgages on the condominium units.

How the Program Can Be Used This program can be used to accomplish rehabilitation and/or improvement of an existing one-to-four unit dwelling in one of three ways:

To purchase a dwelling and the land on which the dwelling is located and rehabilitate it. To purchase a dwelling on another site, move it onto a new foundation on the mortgaged property and rehabilitate it. To refinance existing liens secured against the subject property and rehabilitate such a dwelling. To purchase a dwelling and the land on which the dwelling is located and rehabilitate it, and to refinance existing indebtedness and rehabilitate such a dwelling, the mortgage must be a first lien on the property and the loan proceeds (other than rehabilitation funds) must be available before the rehabilitation begins.

To purchase a dwelling on another site, move it onto a new foundation and rehabilitate it, the mortgage must be a first lien on the property; however, loan proceeds for the moving of the house cannot be made available until the unit is attached to the new foundation.

Eligible Improvements Luxury items and improvements are not eligible as a cost rehabilitation. However, the homeowner can use the 203(k) program to finance such items as painting, room additions, decks and other items even if the home does not need any other improvements. All health, safety and energy conservation items must be addressed prior to completing general home improvements.